Updated at 9:20am PT on 1/4/21: I went through my credit card statements and found 2 more retention offers, so I updated the second table below.

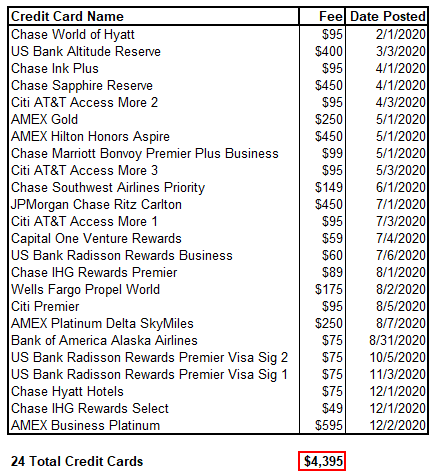

Good morning everyone, I hope your weekend is going well. In December 2019, I wrote I Paid $4,588 in Credit Card Annual Fees in 2019 – Was it Worth it? In that post, I listed all of our credit cards that had annual fees and I attempted to justify why paying over $4,500 in annual fees was worth it. Unfortunately, 2020 made it very difficult to get a ton of value out of our travel reward credit cards, so in March 2020, I wrote Reconsideration Strategy for Credit Card Annual Fees During Coronavirus Pandemic. I decided to list all of our credit cards that have annual fees, sort them by when the annual fee posted / will post, and called for retention offers every time a new annual fee posted. At the beginning of 2020, we had 25 credit cards with annual fees and would pay $4,845 in annual fees if we made no changes or retention offer calls. In this post, I will share what retention offers we received, which credit cards we closed, and which credit cards we product changed.