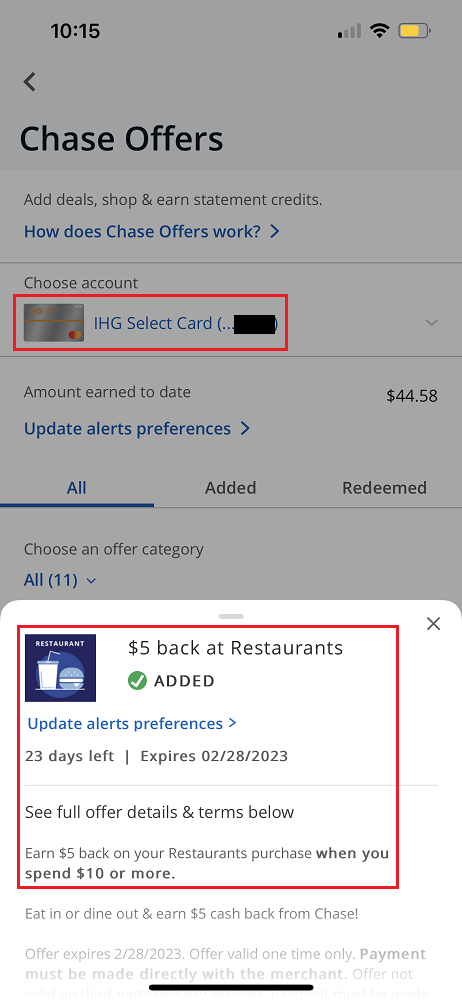

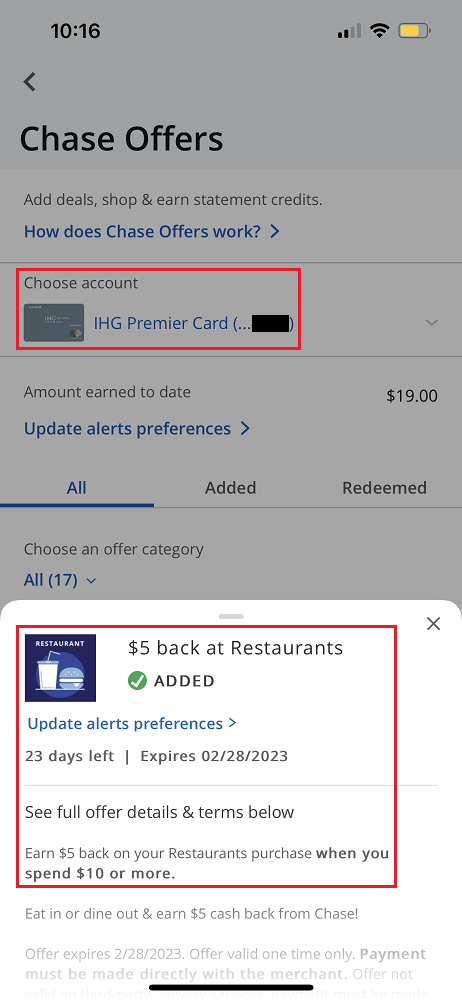

Good morning everyone. A few months ago, I decided to get a Peloton Bike Rental and *try* to get in better shape for 2023. The total monthly cost of the bike rental and all-access membership is $96.56 and this Mashable article explains more about the pros and cons of the rental program along with the cancellation period and buyout options. If you are considering buying a Peloton bike, you might be better off with the rent to own model. Anyway, let’s focus on which credit card is best for Peloton bike rental monthly subscriptions.