Good morning everyone, I hope you all had a great weekend. A few days ago, I noticed that US Bank began offering free credit scores online. Before I review the credit score feature, I wanted to get a few credit card and credit score annoyances off my chest.

[rant on]

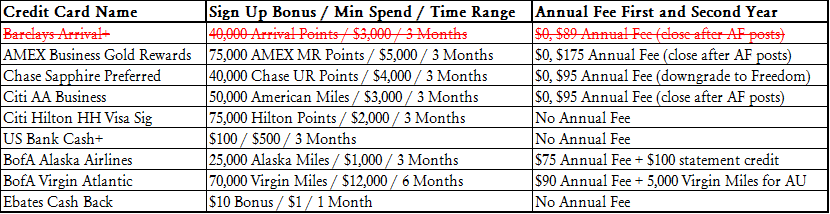

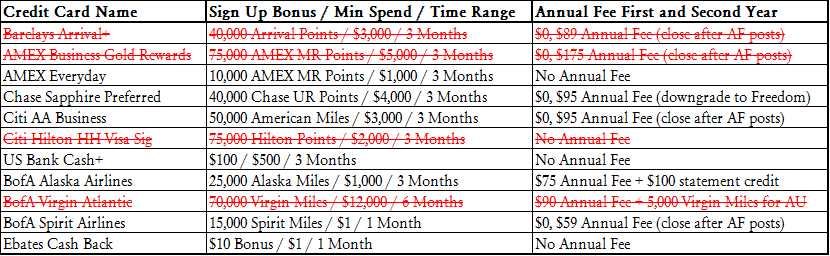

Whenever I talk to people about credit cards, I eventually reveal that I have 30+ credit cards. Since most people think having 2-3 credit cards is a lot, they automatically assume I have thousands of dollars in credit card debt. It is annoying that people assume you have a shopping addiction and have no financial responsibility – that couldn’t be further from the truth.

People also ask about my credit score, since they assume it is 1 static number (like your age or height) – that couldn’t be further from the truth either (below, I compared my credit score from 5 different services). There is actually no single credit score since each credit bureau (Experian, Equifax, and TransUnion) each have their own scoring models and reports, which subsequently produce different credit scores. When people ask me what my credit score is, I don’t tell them a number, but I do say, “I have a great credit score, good enough to be approved for 30+ credit scores.” Here are 2 other annoying misconceptions that I want to put to rest about having 30+ credit cards:

- I do not carry all 30+ credit cards with me at all times – I only carry my Citi Forward and AMEX Old Blue Cash on a daily basis

- I do not use all 30+ credit cards every month – aside from meeting minimum spends on new credit cards, I only use 4-6 credit cards in any given month

[rant off]

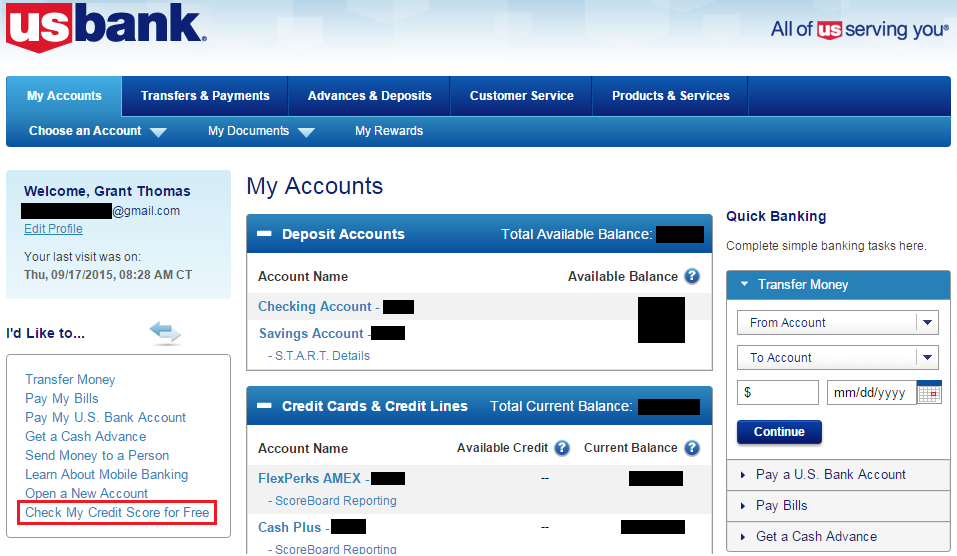

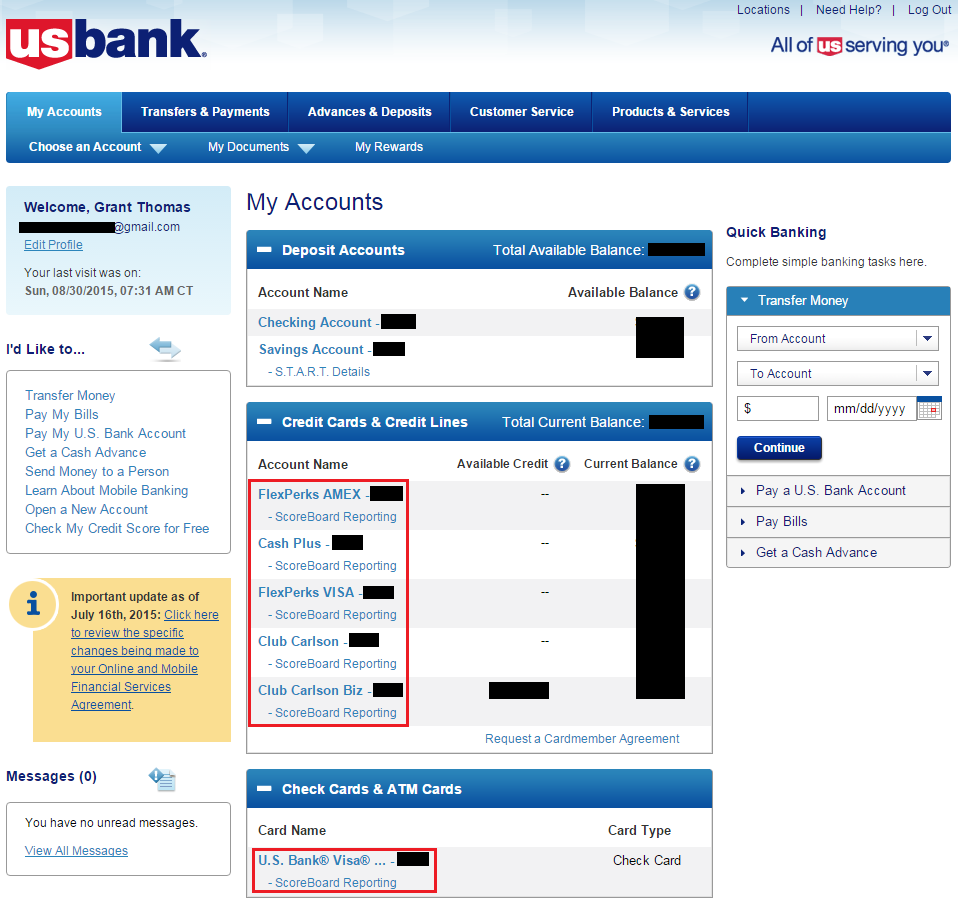

Now with that off my chest, let me show you the new US Bank credit score feature. After you log into your US Bank online account, click Check My Credit Score for Free on the left hand side.