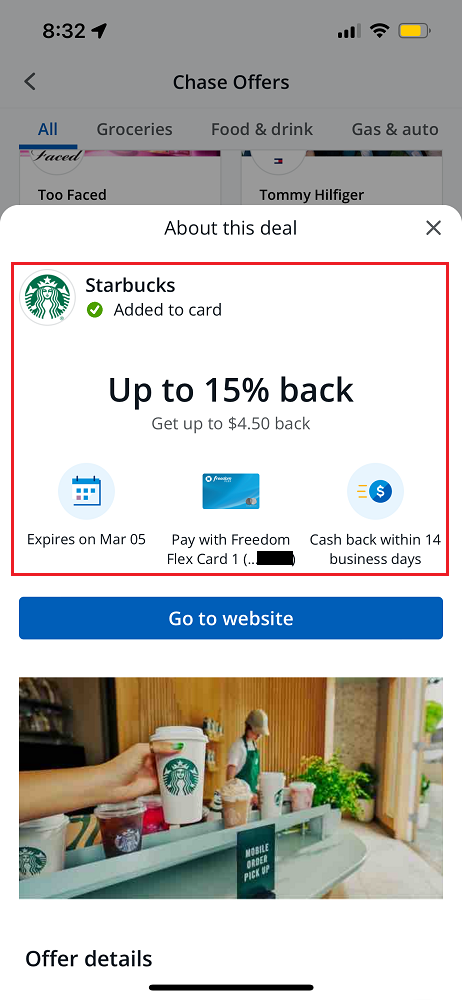

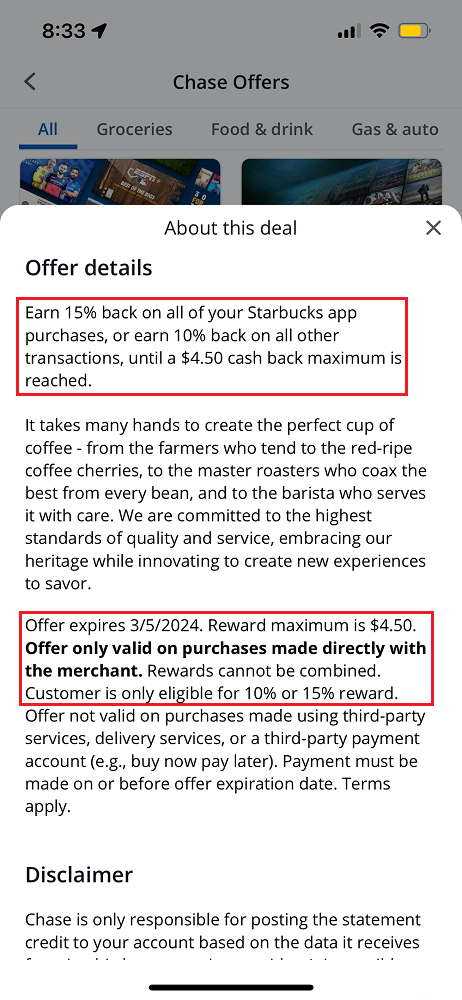

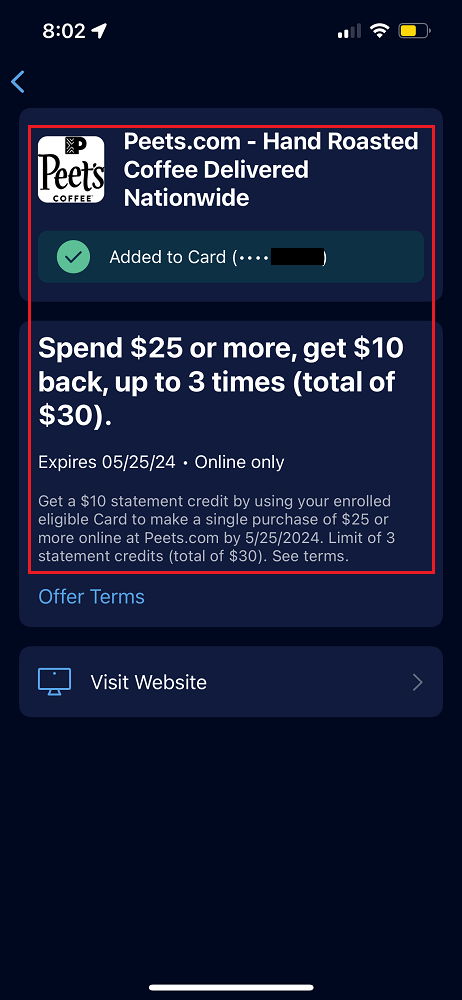

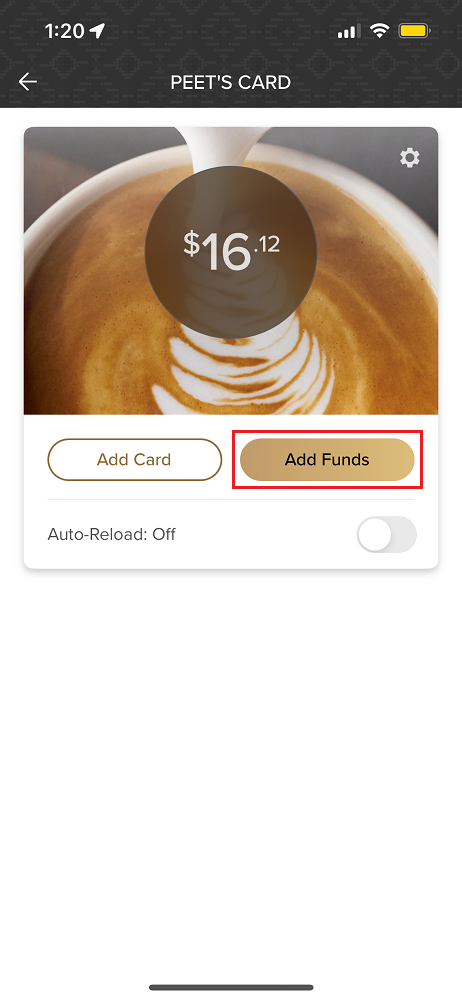

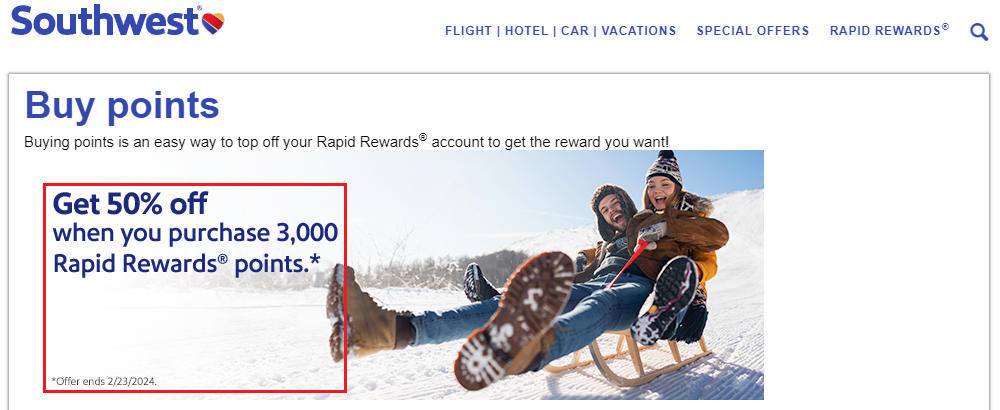

Good afternoon everyone, I hope your week is going well. A few days ago, I wrote Peets Coffee & Tea $10 Off $25 AMEX Offer (Gift Card Balance Reloads Worked). If you are a fan of Starbucks, you won’t want to miss this deal. There is a new Starbucks Chase Offer available where you can earn 15% cash back, up to a $4.50 statement credit on a $30 purchase. I added the offer to all my eligible Chase credit cards and made a $30 Starbucks gift card balance reload and that triggered the Chase Offer. You can repeat that process with each Chase credit card that has the Starbucks offer. Here are the details: