Good afternoon everyone, and happy Friday! A few weeks ago, American Express unveiled their new mirrored-finish Platinum Card lineup, and as a longtime card enthusiast, I knew I had to add this shiny collectible to my collection. Instead of applying for a new card, I logged into my American Express online account and ordered a replacement American Express Business Platinum Card.

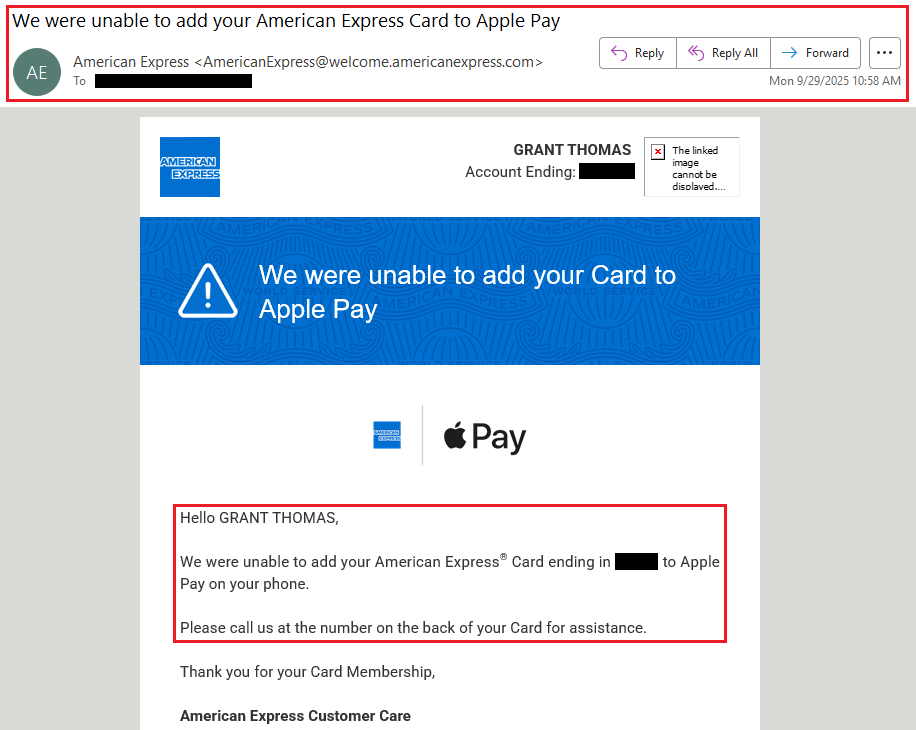

While waiting for the replacement card to arrive, I discovered something interesting: you can’t add your old AMEX Business Platinum Card to your Apple Wallet once you’ve requested a replacement. Every attempt I made to add it resulted in an error until the new mirrored card arrived and was activated.

This post walks you through ordering a replacement AMEX Business Platinum Card, the delivery timeline, design changes, activation process, and adding your new card to your Apple Wallet.