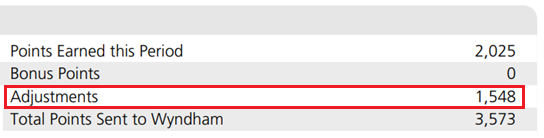

Updated at 1:50pm PT on 3/15/21: I logged into my Wyndham Rewards accounts and saw that I received 462 points as a “Barclays Adjustments.” See the screenshot below.

Updated at 12:40pm PT on 3/11/21: I received a letter from Barclays stating that they are aware of the issue and that they are crediting my account for the correct number of points I earner. See the full letter below.

Good afternoon everyone, I hope you had a great weekend. Last month, I wrote Category Bonus Points Not Posting Correctly for Barclays Wyndham Rewards Earner Business Credit Card. In that post, I wrote about a few examples where bonus categories were not earning bonus points on the new Barclays Wyndham Rewards Earner Business Credit Card. I am happy to report that Barclays has fixed the issue. Here is the update I received from Brian today:

My most recent Wyndham Rewards Earner Business Card statement closed and I received both (a) 5x on new utilities charges for electric and gas charges (each of which received only 1x on the previous statement) and (b) an “adjustment” of points equal to the additional 4x on the electric and gas charges from the last statement about which I inquired via secure message via the card’s website. So, hopefully, the issue is fixed now!