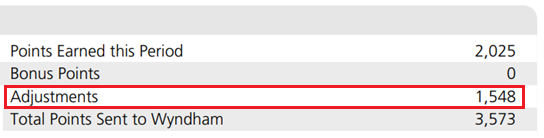

Updated 1:40pm PT on 3/8/21: According to Brian, Barclays has fixed the issue with bonus categories not posting correctly. Here is what Brian said:

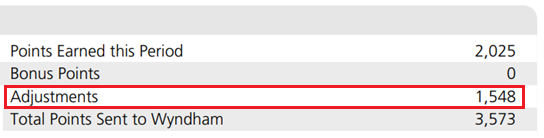

My most recent Wyndham Rewards Earner Business Card statement closed and I received both (a) 5x on new utilities charges for electric and gas charges (each of which received only 1x on the previous statement) and (b) an “adjustment” of points equal to the additional 4x on the electric and gas charges from the last statement about which I inquired via secure message via the card’s website. So, hopefully, the issue is fixed now!

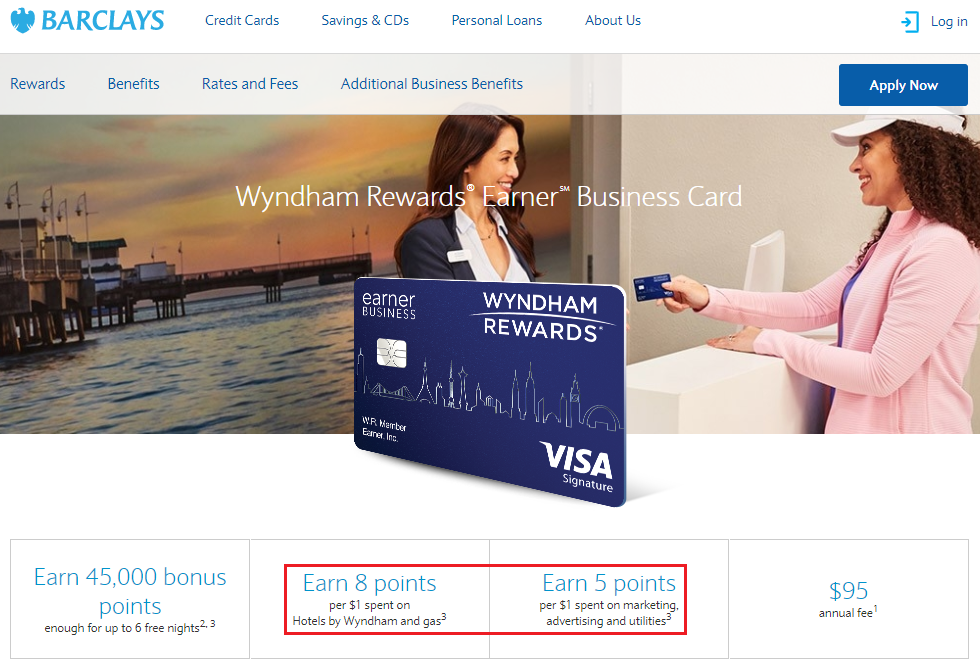

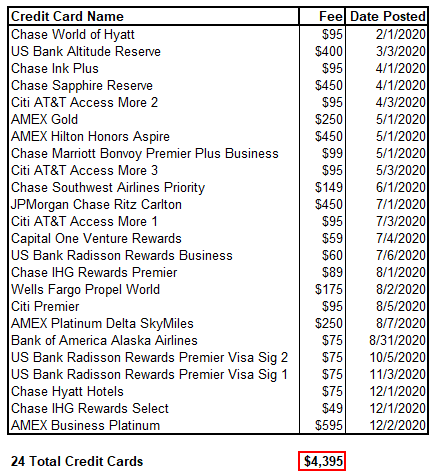

Good morning everyone, I hope your week is going well. A few months ago, I wrote about the Barclays Wyndham Rewards Earner Business Credit Card Application & Reconsideration Process along with the Strange Things About my New Barclays Wyndham Rewards Earner Business Credit Card. A few days ago, my friend Brian reached out to me about this credit card to ask if I had noticed an issue with category bonus points not posting or posting slowly to my Wyndham Rewards account:

Hi Grant,

Have you noticed a delay (or non-posting) of points greater than 1x in the bonus categories with your card?

My first statement recently closed. On it, I had charges for 3 different utilities (water, gas, and electric). Two of the three even had the merchant category as utilities (water was from my municipality; so, merchant code was “government services”). However, none of my charges received the supposed 5x on utilities. I’m curious whether you’ve had similar experiences with your card for 8x on gas or 5x on marketing, advertising services, and utilities?

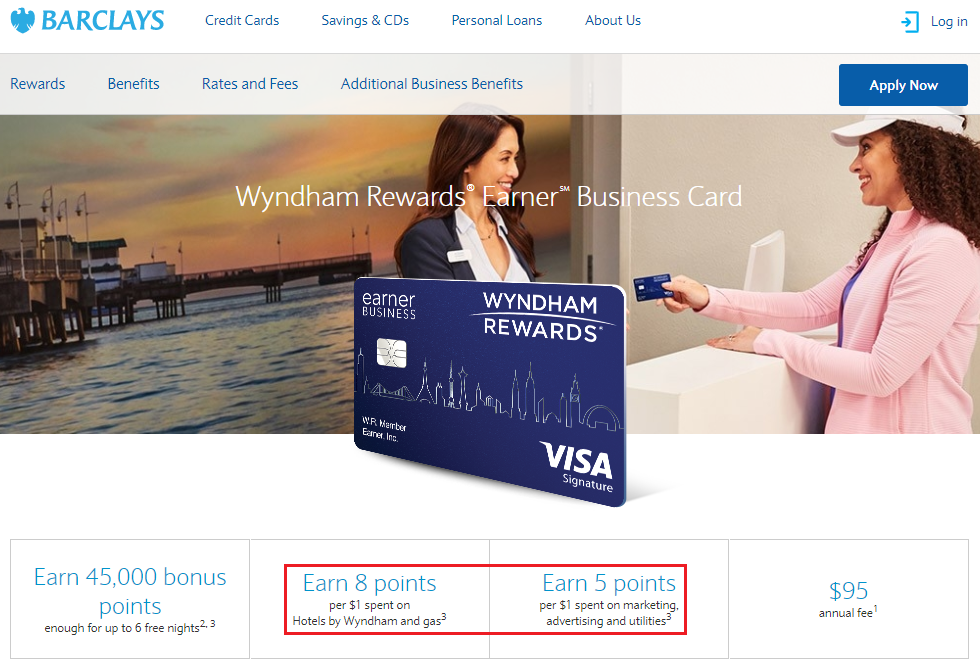

As a reminder, this credit card earns 8x at Wyndham Hotels and at gas stations; 5x on marketing, advertising services, and utilities; and 1x on everything else.

After digging into my credit card statements and searching on FlyerTalk, here is what I found out…

Continue reading →