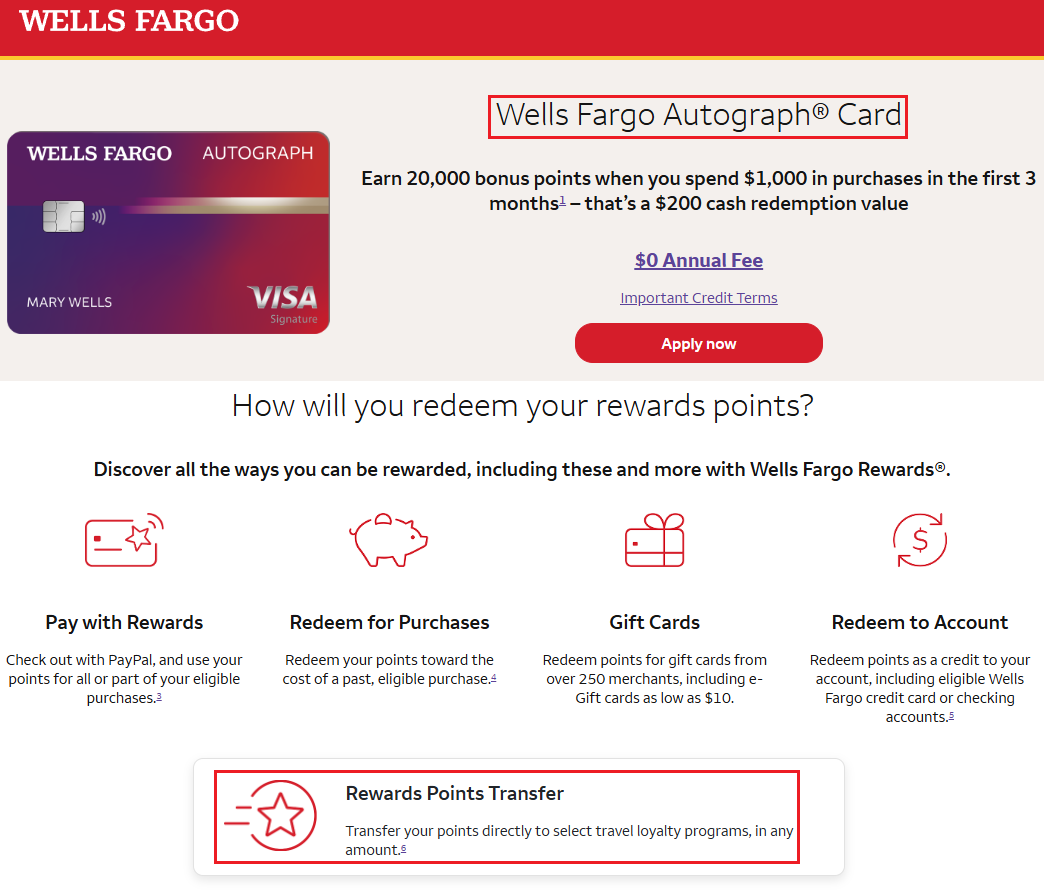

Good afternoon everyone, happy Friday! This morning, I was looking at my Wells Fargo account and trying to decide what my long-term strategy (aka my plan of attack) should be for my stash of 62,320 Wells Fargo Rewards Points. If you were a former Bilt Card 1.0 member, then there is a good chance your card was converted to the no annual fee Wells Fargo Autograph Credit Card. I also currently have the $95 annual fee Wells Fargo Autograph Journey Credit Card. Before I share my strategy, let’s quickly review the bonus categories and transfer partners for the Wells Fargo Rewards program.